By Wes Crill, Ph.D., Dimensional Fund Advisors

One of the most common questions I hear is, “What’s wrong with small caps?” This concern usually stems from relative returns over the past 10 years, during which U.S. small caps underperformed the S&P 500 Index by a little over four percentage points. But which one of these asset classes has been behaving abnormally?

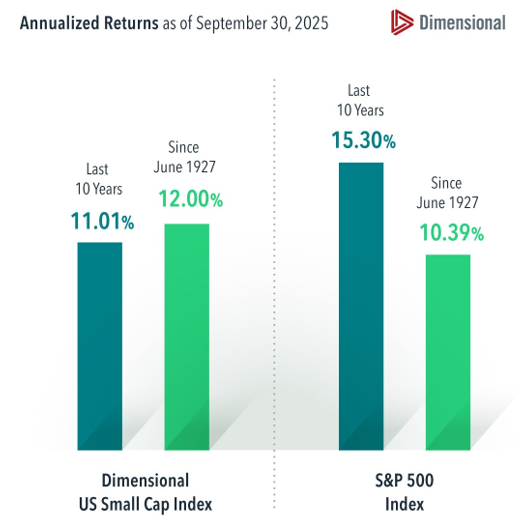

The U.S. small-cap return over the last decade was within one percentage point of its average since 1927, at 11.01% vs. 12.00%. The large-cap S&P 500, on the other hand, was far from its long-run average. The index returned more than 15% over the last 10 years, nearly 50% more than its average since 1927 of 10.39%.

The S&P 500 has substantial weight in companies like the Magnificent 7 that have exceeded investor expectations with their earnings growth in recent years. When investors are surprised in a good way, outsize returns may follow. That’s a windfall for investors with diversified portfolios. But expecting a continuation of large-cap returns well in excess of the historical norm is betting on further unexpected success stories for these firms.

Many people have been searching for stories to explain U.S. small-cap underperformance. We’ve written previously about looking at the bigger picture with small-cap returns and how some of the concerns over the current opportunity set may be overblown. But the stark contrast between short-term and long-term large-cap returns suggests that maybe investors are questioning the wrong segment of the market.

Past performance is not a guarantee of future results. Actual returns may be lower. In USD. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. The Dimensional US Small Cap Index represents academic concepts that may be used in portfolio construction and is not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of the Dimensional index data. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.