It’s hard to believe we’re already over halfway through the year. When time moves this fast, it’s easy to fall behind on our most important savings goals.

If you contribute to your retirement accounts regularly, you’re probably in good shape. But for those who contribute sporadically or in larger chunks throughout the year, it’s worth checking your progress.

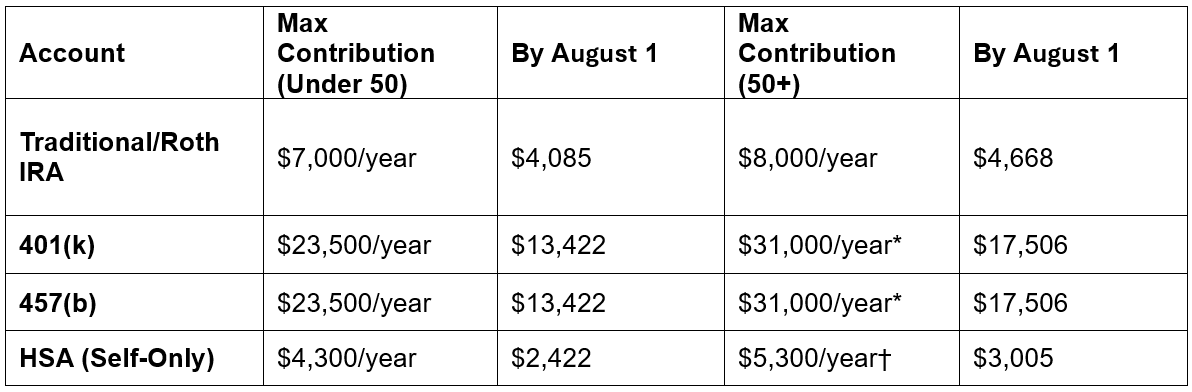

The chart below shows the 2025 contribution limits for qualified retirement plans—along with how much you should have contributed by midyear if you’re aiming to max out by year-end.

* Includes $7,500 catch-up for ages 50–59.

† Includes $1,000 catch-up for ages 55-plus.